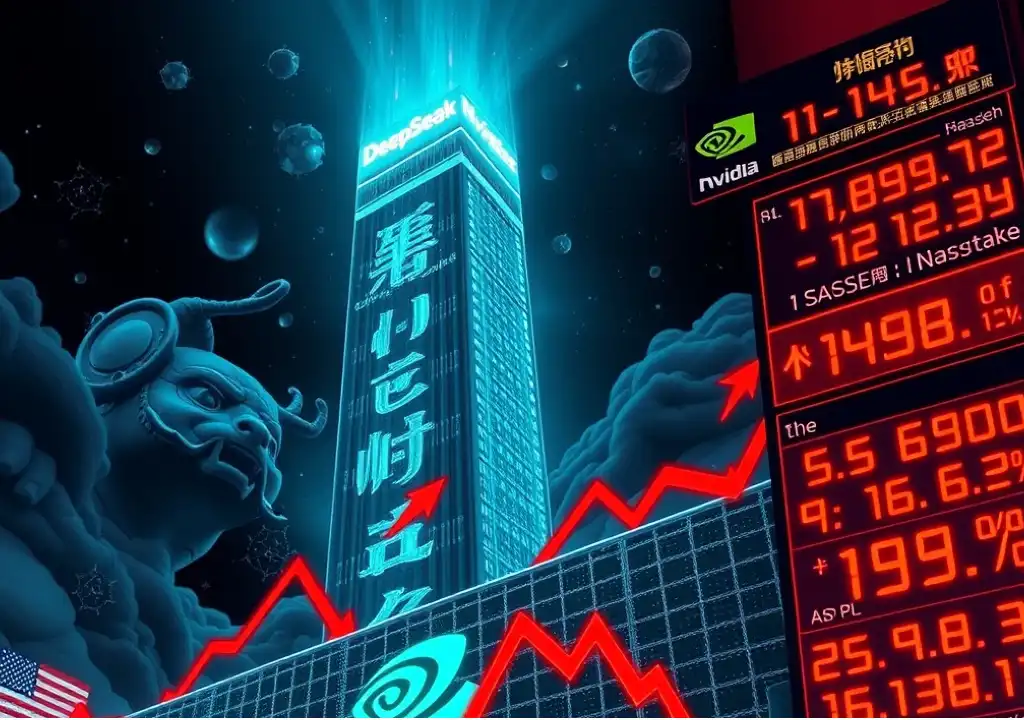

A new challenge from a Chinese firm has rattled financial markets, with DeepSeek’s AI application causing a sharp decline in AI-related stocks, including Nvidia.

On Monday, the S&P 500 dropped 1.7%, headed for its worst day in over a month, with Big Tech companies taking significant losses. Nvidia’s shares plummeted 14.4%, dragging the Nasdaq down 2.8%. Other sectors less tied to AI fared better, with the Dow Jones Industrial Average only losing 0.1%, briefly showing a gain earlier in the day. The shockwave came from China, where DeepSeek announced it had developed a large language model that could rival US giants at a much lower cost.

By Monday morning, DeepSeek’s app had already topped Apple’s App Store chart, an impressive feat considering the US government’s restrictions on Chinese access to high-end AI chips. Silicon Valley venture capitalist Marc Andreessen called DeepSeek’s R1 model a “Sputnik moment,” referencing the Soviet Union’s space race victory over the US in the 1950s, and praised the open-source model as a remarkable gift to the world.

However, skepticism remains about DeepSeek’s ability to circumvent US chip restrictions. Wedbush Securities’ Dan Ives noted the doubts surrounding DeepSeek’s ability to bypass these challenges, given that the announcement is coming from China.

Despite the doubts, DeepSeek’s reveal caused a stir in global markets. In Amsterdam, ASML, a Dutch chip supplier, saw its shares fall by 6.6%. In Tokyo, Softbank Group dropped 8.3%, returning to pre-announcement levels after joining a partnership to invest in AI infrastructure. On Wall Street, Constellation Energy’s stock dropped 19% after announcing it would restart the Three Mile Island nuclear plant to power data centres for Microsoft.

Investors sought safety in bonds, reacting to the downturn, which marked a sharp contrast to the recent bullish trend in AI stocks. Nvidia, for example, had seen its share price surge from under $20 to over $140 in just two years. The so-called “Magnificent Seven” — including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla — had been at the forefront of the AI frenzy, contributing significantly to the S&P 500’s returns last year.

These companies’ dominance in the market raises concerns over “concentration risk,” with a few giants controlling much of the market. Brian Jacobsen, chief economist at Annex Wealth Management, warned that while the DeepSeek news might be overstated, it also presents potential new investment opportunities.