Despite Elon Musk’s increasing influence, Tesla shares are struggling, with the company facing declining electric vehicle sales and rising concerns over Musk’s political involvement.

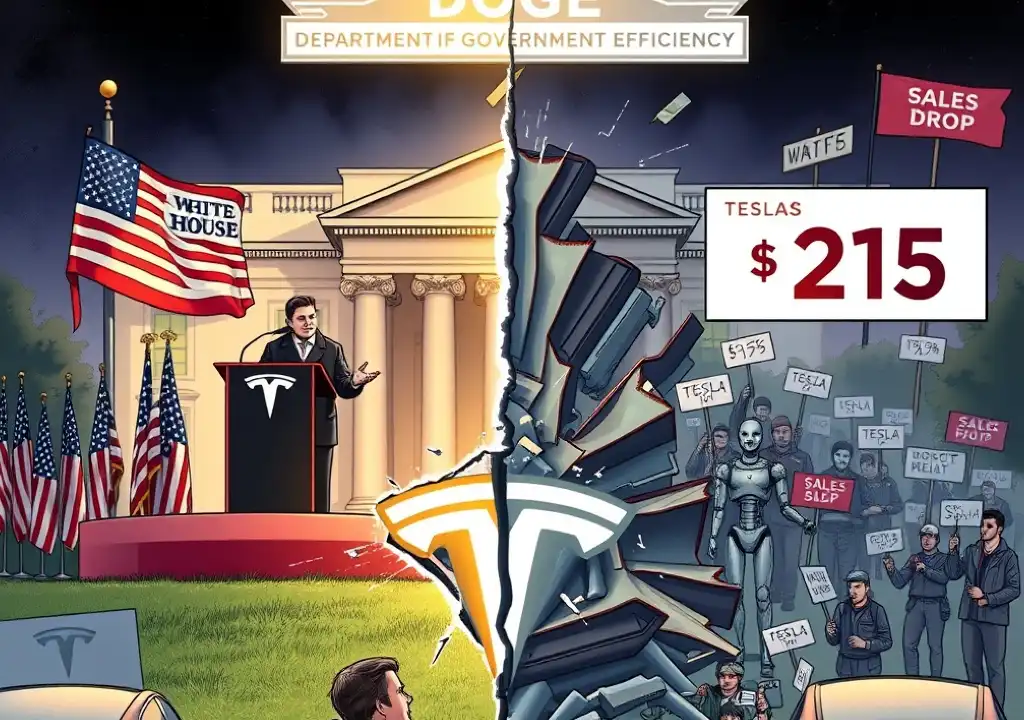

The close relationship between President Donald Trump and Elon Musk was highlighted on Tuesday as the White House South Lawn showcased Tesla’s latest innovations. Trump even vowed to label anyone vandalizing a Tesla as a “domestic terrorist” in light of increasing attacks on the electric vehicle company’s cars. Musk’s prominence in Trump’s administration is marked by his leadership of the Department of Government Efficiency (DOGE), a controversial entity claiming to have uncovered “billions in waste, fraud, and abuse” within the U.S. government, though no substantial evidence has been provided to back this claim.

In the midst of this political spectacle, Tesla’s stock has taken a sharp downturn. This Monday, shares plummeted by 15%, reaching $215 – the biggest drop since 2020 and the lowest point since Trump’s election win in November. Despite a slight recovery to $231.83 after Tuesday’s White House promotion, the stock struggled to gain significant traction, remaining below $240 by Friday morning. Tesla’s stock has seen a dramatic fall from its high of $435 in mid-December 2024. The question remains: Why is Tesla struggling when Musk appears to be at his most powerful?

Reasons Behind Tesla’s Declining Share Price

Tesla’s stock, which had been soaring after the U.S. presidential election in November, has been volatile throughout 2024 and has plummeted this year. Robert Scott, an expert in international economics, argued that the fall was expected due to Tesla’s “extreme overvaluation,” with its price-to-earnings ratio being one of the highest ever recorded. This suggests that the stock price was not supported by the company’s actual earnings. William Lee, Chief Economist at the Milken Institute, believes delays in launching new products, such as the updated Tesla Model Y, and the absence of new models, have contributed to the stock’s decline.

Sales Struggles Across Key Markets

Tesla’s vehicle sales have significantly dipped, particularly in Europe. February saw a dramatic 76% drop in sales in Germany, despite an overall rise in electric vehicle sales by 31%. Similar declines were seen in Norway, Denmark, and Sweden, with Tesla sales falling by 40% in February, while sales in France dropped by 26%. The company also saw a 50% year-on-year drop in China and an even steeper 71% fall in Australia. This decline can be attributed to intensified competition from established carmakers and emerging electric vehicle companies, particularly in China. Tesla’s efforts to slash prices in a bid to stimulate demand have had a short-term effect but hurt long-term profitability, raising concerns among investors.

Failure to Deliver Innovation

Tesla’s lack of progress in self-driving technology and other key innovations has put a strain on investor confidence. Lee notes that investors are becoming increasingly concerned about the company’s inability to meet its promises regarding autonomous driving and robotics, both of which have been delayed multiple times. The lack of new models or major technological breakthroughs has contributed to the perception that Tesla is losing its edge as an industry leader, further impacting its stock.

Musk’s Personal Financial Strain

Elon Musk’s personal wealth is closely tied to Tesla’s stock price, and the recent decline has affected him personally. His other ventures, such as the $44 billion purchase of X (formerly Twitter), are proving financially burdensome. Advertising pullbacks on the platform, worsened by Musk’s right-wing political endorsements and his active use of X to promote his pro-Trump stance, have further strained the platform’s financial health. Additionally, Musk’s political activities, including his support for Trump’s campaign and involvement in DOGE, have led to protests and vandalism targeting Tesla properties across the U.S. and Europe.

Political Involvement as a Distraction

Musk’s growing political presence, especially in DOGE, has led to concerns that his focus is diverted from running Tesla and pushing innovation forward. Scott argues that DOGE’s moves, such as attempting to scale back government spending, may harm the economy and, by extension, Tesla’s performance. Lee concurs, noting that Musk’s participation in government affairs is distracting him from Tesla’s performance and ability to meet its product promises.

Trump’s Trade Policies and Their Impact on Tesla

Although Trump isn’t directly responsible for Tesla’s struggles, his policies, including tariffs on China, could have serious implications for the company. The trade war with China risks disrupting Tesla’s supply chain and reducing its competitiveness in a key market. Trump’s opposition to subsidies for electric vehicle manufacturers and emissions regulations could further weaken demand for Tesla’s cars, making it harder for the company to maintain its market dominance.

Musk’s Expanding Business Interests

Musk’s broadening business ventures, from DOGE to his personal cryptocurrency projects, have raised concerns over his ability to lead Tesla effectively. Scott points out that Musk’s distractions could be undermining his companies’ growth. Additionally, his increasingly right-wing political stance has alienated some of Tesla’s environmentally conscious customer base. Investors are questioning whether Musk is prioritizing his political ambitions over the future of Tesla, which could have long-lasting effects on the company’s market standing.

In conclusion, while Musk’s political clout has grown, it seems to have become a double-edged sword for Tesla. His distraction with government roles and public political stances, combined with competitive pressures and a lack of innovation, has led to a significant decline in Tesla’s stock and sales.